Contents:

They are designed to help you track intercompany transactions on accounts receivable reports and track intercompany accounts payable vouchers on accounts payable reports. A subsidiary in Germany enters into a transaction with a subsidiary in the United States. The entity in Germany records the transaction in euros, while the entity in America records the transaction in dollars. This results in an out-of-balance intercompany transaction with potential tax complications. If the entities use different enterprise resource planning systems, validating the journal entries is complicated by the systems’ different characteristics.

They allow the business to record and evaluate all financial activity thoroughly and accurately. The more generic allocation model involves setting a cost per person and allocating that figure to intercompany entities based on the number of people allocated to that entity. It essentially involves providing a good or service to an entity and recovering the cost from the entity served on a fee basis. Intercompany recharging happens when one entity incurs a cost and then bills, invoices, or moves that cost to another entity in the larger organization.

AVENUE THERAPEUTICS, INC. Management’s Discussion and Analysis of the Results of Operations (form 10-K) – Marketscreener.com

AVENUE THERAPEUTICS, INC. Management’s Discussion and Analysis of the Results of Operations (form 10-K).

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

Compare the effect on Income Statement expense results if you use an employee-centered approach to Intercompany Billing versus a project-centered approach. This form displays only those posting logs that contain intercompany labor or expense entries. If one of the LLCs is always used to pay the bills, then you would want to set up a receivable for all of the possible companies that would have bills paid on their behalf. For instance, the LLC (let’s call it LLC One) that pays the utility bill should only expense half of the bill when coding the charge and code the other portion to the receivable from LLC Two.

Challenges of Intercompany Accounting

We’ll also cover the basics of what there is to know about intercompany accounting so you can ensure compliance and maintain accurate books. BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate. Our cloud software automates critical finance and accounting processes. We empower companies of all sizes across all industries to improve the integrity of their financial reporting, achieve efficiencies and enhance real-time visibility into their operations. The removal of transactions between parent and subsidiary companies from the financial statements is called intercompany eliminations.

If you do this, employees enter charges to the project, phase, or task component that has been assigned to their company through the organization structure. This approach holds each company tightly accountable for its portion of the contract. The project’s compensation can be explicitly divided among the companies and each company can establish a separate budget for its work. This project is managed by the head office in the Netherlands while the actual implementation is performed by staff from the local departments. The local departments charge the head office for the hours and expenses spent on the project. In People, employees can book hours and expenses for various projects or orders.

Intercompany Transactions Accounting: Best Practices

For example, a firm may sell merchandise from one division to another division of the same company, or a parent company might lend money to one of its affiliates. Intercompany eliminations are easy to miss.So that no intercompany transactions slip through the cracks, companies must put controls in place. You must also specify an intercompany organization, so that Vantagepoint knows how to handle implicit postings for intercompany transactions. If intercompany trade is set up for hours and expenses, the application creates intercompany trade orders for each hours or expense booking in the relevant sessions in People. On the intercompany trade order, a general hours or expense booking is displayed as the originating object. When hours or expenses are booked for an order or a project, the order or project is the originating object, and the hours or expense booking is the related object.

- The group’s transfer pricing policy specifies that Company G should pay 40% of its sales to Company F in respect of use of the intellectual property.

- In this type of transaction, the parent company records the transaction and applicable profit or loss.

- Amounts subtracted from gross income are not considered earnings and profits of any member and are not classed as exempt income.

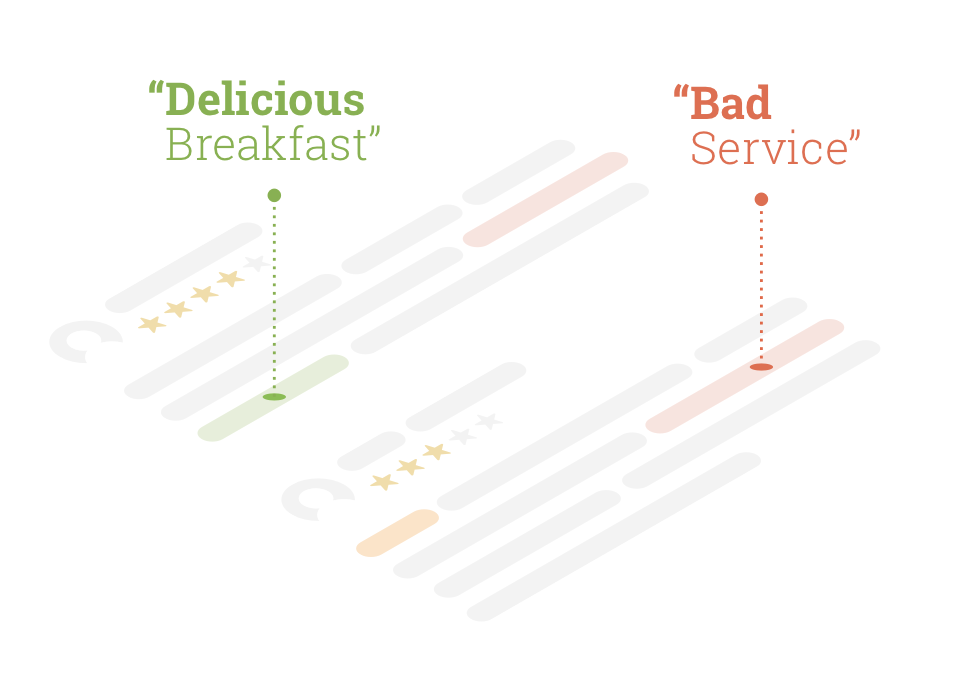

- Automatically process and analyze critical information such as sales and payment performance data, customer payment trends, and DSO to better manage risk and develop strategies to improve operational performance.

- On February 24, 2023, the Wisconsin Tax Appeals Commission issued a ruling1 disallowing a taxpayer’s deduction for certain intercompany royalty and interest expenses the taxpayer paid to an affiliate.

With the right automation solution in place, you can devise and carry out a master data management program that spans across various companies. This program will be aligned with the policies set forth by the parent company and ensure the proper passage of information between relevant parties. This means that there needs to be extra attention to each of the company’s financial statements. Intercompany Expenses – Set to Allow to permit expenses transactions where the employee and customer have different subsidiaries.

Difference Between Departmental Accounting and Branch Accounting

Working capital, cash flows, collections opportunities, and other critical metrics depend on timely and accurate processes. Ensure services revenue has been accurately recorded and related payments are reflected properly on the balance sheet. Basic spreadsheet use may become ineffective as intercompany accounting becomes more complex.

The revenue cycle refers to the entirety of a company’s ordering process from the time an order is placed until an invoice is paid and settled. The inability to apply payments on time and accurately can not only lock up cash, but also negatively impact future sales and the overall customer experience. F&A leadership can have a significant impact by creating sustainable, scalable processes that can support the business before, during, and long after the IPO.

Small-Business Planning Financial Software

The issue is of particular concern when an acquisition has just been completed, since the reporting controls are not yet in place at the new acquiree. If an enterprise resource planning system is in place throughout the company, these transactions can typically be identified by flagging a transaction as it is created as being an intercompany item. The potential consequences of these risks sometimes make news headlines. Securities and Exchange Commission include lawsuits and penalties against companies and their officers.

The subsidiary or subsidiaries record a lateral transaction along with the profit or loss, which is similar to accounting for an upstream transaction. An example is when one subsidiary provides information technology services to another subsidiary for a fee. To perform intercompany reconciliation, remember that the days of manual reconciliation are long gone! Your accounting team has more important fish to fry, so empower them with an automation solution that will perform data collection and transaction matching for them.

Yet these tasks are critical to the financial information’s integrity. It helps to create a spreadsheet to show all of the possible accounts between all of the companies. Print this spreadsheet out and always make sure to fill it out at the end of the day to make sure you handled everything correctly. These account balances need to be checked continuously to make sure that the balance always ties.

This multidimensional functionality investing activities includes intercompany accounting and all of its related issues regarding taxes, foreign currency and treasury. Similarly, automated balancing and netting enables more timely access to consolidated financial results. Additionally, a company can better enforce its standards and policies for transfer pricing by using NetSuite’s built-in price books, which keeps tax authorities happy. Without thorough and accurate intercompany accounting, companies leave themselves open to vulnerabilities, and can’t properly reconcile transactions that take place between entities or accurately assess profits and losses. This undermines the ability of the parent company to prepare accurate consolidated financial statements.

NETWORK CN INC MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K) – Marketscreener.com

NETWORK CN INC MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K).

Posted: Thu, 13 Apr 2023 21:25:12 GMT [source]

BlackLine and our ecosystem of software and cloud partners work together to transform our joint customers’ finance and accounting processes. Together, we provide innovative solutions that help F&A teams achieve shorter close cycles and better controls, enabling them to drive better decision-making across the company. Increase accuracy and efficiency across your account reconciliation process and produce timely and accurate financial statements.

Philip Morris International : Glossary and Non-GAAP Reconciliations – Marketscreener.com

Philip Morris International : Glossary and Non-GAAP Reconciliations.

Posted: Thu, 20 Apr 2023 11:15:19 GMT [source]

Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. You can set the default content filter to expand search across territories. Stay up to date on the latest corporate and high-level product developments at BlackLine.

Explain why accountants have to classify items as capital or revenue expenditures. Discuss why a partnership is viewed in accounting as a “separate economic entity”. In this lesson, we define data consolidation as the process of combining large amounts of data, creating usable portions of information for database storage.

QuickBooks Online Banking is a great tool, but if you get too comfortable downloading transactions, you can lose control of the amounts owed between all LLCs. It would make sense to use a different credit card for each LLC, but sometime that isn’t too practical if someone owns 10 LLCs. You’ll need to also define a cash management strategy for dealing with cash transactions.

It is necessary to eliminate the intercompany income and cost of sales resulting from the transaction in the consolidated financial statements. Eliminate intercompany receivables and payables, purchase, sales costs, and profit/loss from transaction accounts in the consolidated financial sheet. Properly tracking and accounting for revenues and expenses is paramount for any business, large or small. As a company grows, it may form smaller subsidiary companies to focus on specific niche markets. This is where intercompany accounting comes in, giving the parent company the necessary information to appropriately account for expenses, evaluate successful subsidiaries and file taxes. The risks of a poorly managed intercompany accounting process are most evident in financial misstatements, but they also impact several other areas across a company.